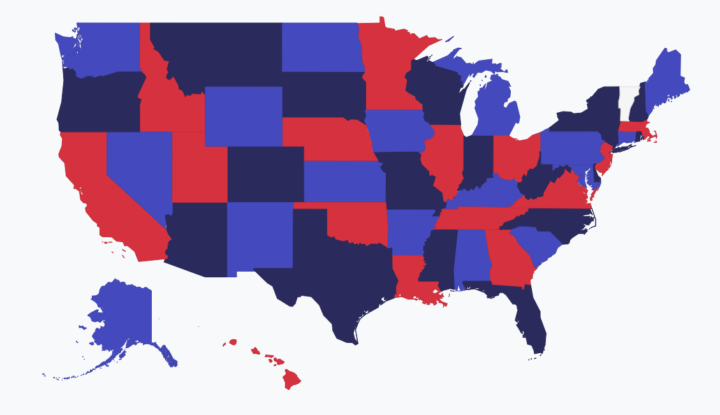

Washington, D.C. – Today Americans for Tax Fairness released the latest updates on the Trump Tax Cut Truths website detailing how businesses are spending their tax savings since the passage of the Tax Cut and Jobs Act. The updates include a searchable map allowing you to easily find out how corporations headquartered in each state are spending their tax savings, a feature to allow the sorting of data by state, as well as new data showing that corporations have announced a record $407 billion on stock buybacks since the tax law passed Congress in December.

“President Trump and Congressional Republicans promised that their massive tax cuts for the wealthy and big corporations would result in workers’ pay increasing by at least $4,000 a year. Instead big corporations have doled out over $407 billion to wealthy stockholders and executives since the tax law passed and promised just $7 billion to workers in one-time bonuses or minimum wage increases,” said Frank Clemente, executive director of Americans for Tax Fairness. “Shockingly few workers are getting any pay hikes, as corporations have committed 59 times as much to buying back their stock as they have promised to their workers.”

The Trump Tax Cut Truths website maintained by Americans for Tax Fairness is the most comprehensive database on the web tracking what corporations are doing with their Trump-GOP tax cuts from last year’s Tax Cuts and Jobs Act.

Key Updated Figures:

- New stock buyback announcements since the tax bill was passed in December are at $407 billion, up from $238 billion on April 9 when the website was launched — an increase of 71%. The richest 1% own 40% of all stock; the richest 10% own 84%. Stock buybacks waste money that could be used for useful investments that create jobs and give workers higher pay. Major new stock buyback announcements include:

- Apple: $100 billion, 5/1/18

- Qualcomm: $8.8 billion, 5/9/18

- Starbucks: $5.9 billion, 4/26/18

- Electronic Arts: $1.8 billion, 5/8/18

- Royal Caribbean Cruises: $1 billion, 5/9/18

- Bonuses and wage increases have only increased to an estimated $6.9 billion, up about 6% from $6.5 billion when the website launched.

- Corporations have committed 59 times as much to buying back stock as they have promised to workers in bonuses and wage hikes.

- A total of 6.5 million workers out of 155 million U.S. workers are getting a wage hike or a bonus, up from 6.3 million out of 155 million on April 9.

- 398 businesses out of 26 million businesses are providing a bonus or wage hike, up from 383 businesses on April 9.

- Total tax cuts for 153 corporations in 2018 is estimated at $76 billion vs. $6.9 billion in bonuses and wage hikes; that’s up from a total of $60.8 billion in tax cuts for 120 corporations on April 9 vs. $6.5 billion in wage hikes and bonuses.

- Over 130,000 jobs cuts have been announced since the tax law was passed; that’s up from 94,000 on April 9.

Americans for Tax Fairness is a diverse campaign of more than 425 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

###